The 2026 Indian Budget aims to transform the Customs system into a predictable pipeline. The goal is trust based movement, fewer repeated checks, and better-connected approvals

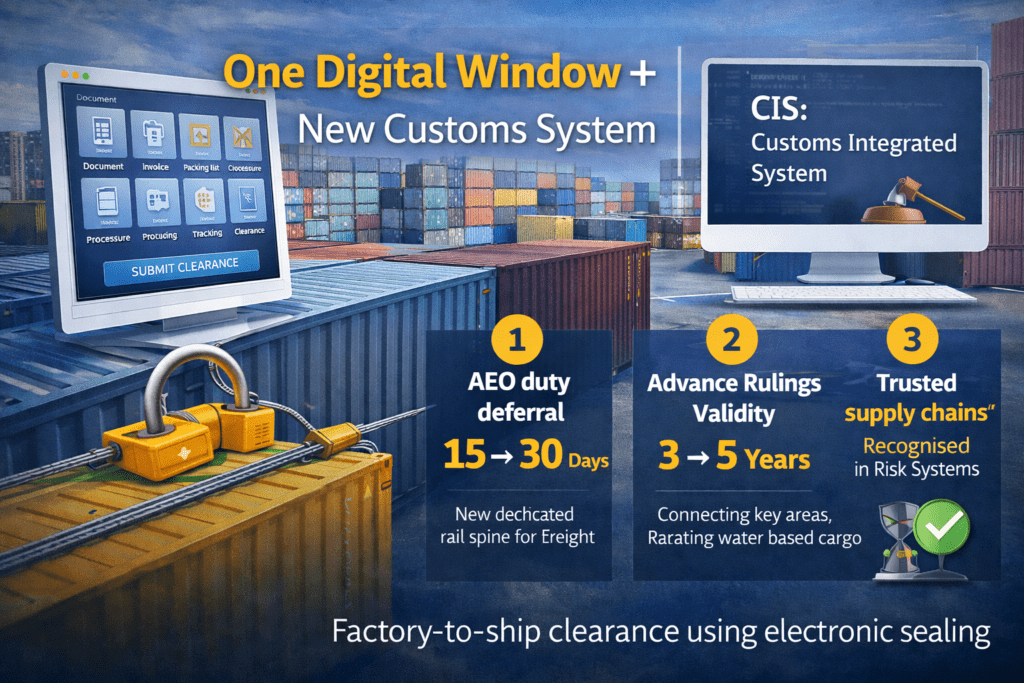

The government is introducing a single, interconnected digital window for cargo approvals. This “Customs Integrated System” (CIS) is planned for rollout within two years.

1) AEO duty deferral: 15 → 30 days (Tier 2 & Tier 3)

For smaller cities and growing exporters/importers, cashflow is often tighter than paperwork.

Extending duty deferral to 30 days for Tier 2 and Tier 3 AEOs and extending similar benefit to eligible manufacturer importers is a real working capital lever.

2) Advance rulings: validity 3 → 5 years

A longer validity for advance rulings means fewer repeat disputes and fewer “new officer, new interpretation” cycles for the same item.

3) “Trusted supply chains” recognised in risk systems

The budget signals that long-standing, trusted importers can be recognized so the need to verify cargo every time can be reduced.

Factory-to-ship clearance using electronic sealing

Export cargo using electronic sealing can be provided clearance from factory premises to the ship.

Benefits: this reduces

- repeated handling

- extra stoppages

- last-mile uncertainty

- time wasted re-proving what you already proved

Warehousing: moving to an operator-centric framework

It also points to transforming customs warehousing into a more operator-centric system with self-declarations.