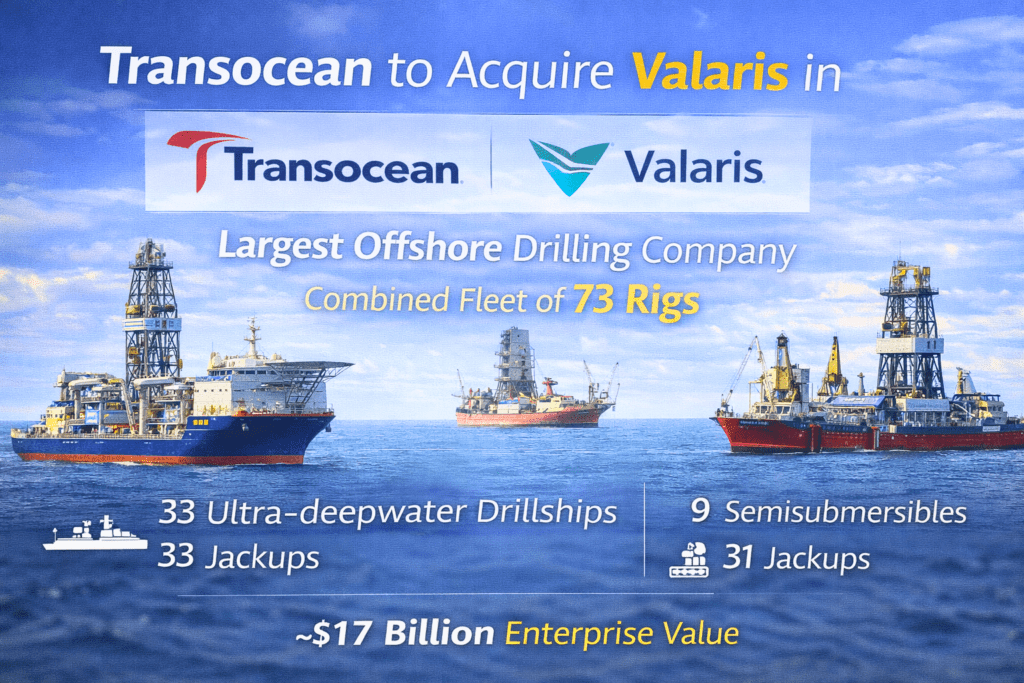

Transocean has struck a deal to acquire competitor Valaris in a $6 billion stock transaction.It effectively creates the largest offshore drilling contractor on the planet, with a combined enterprise value of roughly $17 billion.

The most significant aspect of this deal is the fleet composition. The combined company will operate 73 rigs in total:

- 33 Ultra-deepwater drillships

- 9 Semisubmersibles

- 31 Jackups

For those following Transocean’s history, the addition of those 31 jackups is a major pivot. Nine years ago, Transocean exited the shallow-water market entirely, selling its jackup fleet to Borr Drilling for $1.4 billion during the industry downturn. By buying Valaris, Transocean is jumping back into that sector with both feet.

As Valaris CEO Anton Dibowitz put it, the new company can now operate “any rig at any water depth in any offshore environment.”

Transocean shareholders will hold a 53% stake in the new entity. The deal, expected to close in the second half of the year, is projected to unlock about $200 million in cost savings (synergies). Management is also bullish on cash flow, aiming to pay down debt to a healthy leverage ratio of 1.5x by 2028.

Valaris stock jumped 22% on the news, though both stocks saw a correction of about 8% the following day as traders digested the details.