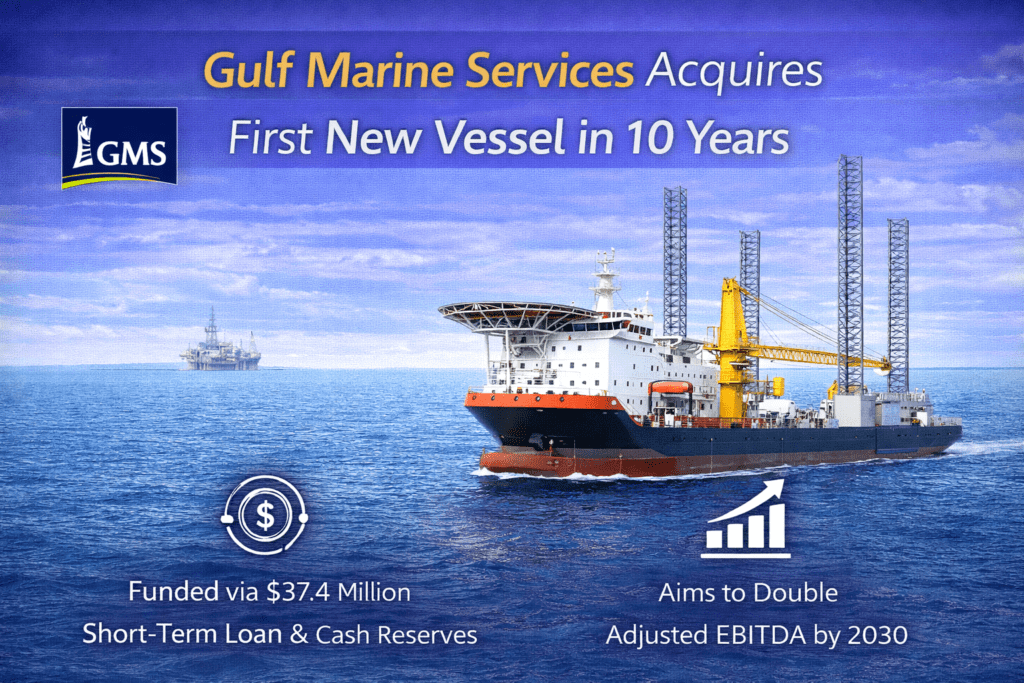

Gulf Marine Services (GMS), a specialist provider of jack-up support vessels for the offshore energy sector, is adding a new mid-sized, self-propelled, self-elevating support vessel to its fleet its first vessel purchase in the last 10 years.

The vessel is expected to be delivered and added to GMS’ 14-vessel fleet within the next two weeks. The company says the acquisition supports its long-term plan to grow earnings, including a target to double adjusted EBITDA (a common profitability metric) by 2030.

To fund the purchase, GMS used a mix of debt and cash. Part of the deal was financed through a $37.4 million short-term (90-day) interim loan from a Middle Eastern bank that already participates in the company’s lending group. The balance was paid from GMS’ cash reserves. GMS added that the loan pricing and key terms match what it previously agreed with lenders in December 2024, and that post-deal net leverage is expected to stay below 2.0x (excluding any earnings from the new vessel).

GMS said the vessel is already being lined up for specific commercial opportunities, and it plans to share updates on backlog and its 2026 adjusted EBITDA guidance in a future announcement. Executive Chairman Mansour Al Alami called the deal a major milestone and said the company may consider more acquisitions depending on market conditions, alongside plans to begin a shareholder reward program in the coming months.